More than 50 years ago, TaxSlayer began as just a tool for accountants & professional tax preparers. Since the 1990s, the company has had a strong presence in the individual income tax preparation software market. This year, we’re focusing on TaxSlayer Classic, which offers cheap support for all main IRS forms and schedules. TaxSlayer Classic has remained among the best tax software due to its cost and thorough covering of tax topics.

Taxslayer includes a detailed description of typical Form 1040-related issues as well as an accessible database with help files (updated again for the current tax year) and guidance. The current edition offers some new features and improvements such as a focus on the child tax credit, improved navigation & efficiency, more targeted assistance, and modifications to the general user experience. Because the site’s new skill to upload CSV files detailing investment transactions and the upgrades to the Quick File tool were not yet online.

What you will see here?

Cost

Through its online Federal portfolio, TaxSlayer offers four grades of service, ranging from free to $47.95.

The services have a slightly different structure than competing tax-preparation software. Simply Free is exactly that, and it takes care of W-2 forms as well as education credits and deductions. Most tax concerns are handled by the $17.95 Classic tier. While Premium ($37.95) offers premium phone and email service as well as expert advice from Ask a Tax Pro. The $47.95 Self-Employed category is suited for those who contract, freelance, or have a side hustle, according to the description (technically, the necessary tax forms are in the Classic version, however, you need to go to Self-Employed to get a tax expert help).

TaxSlayer has a separate Military tier on its site menu. This allows active service members to file their federal returns for free.

TaxSlayer Classic State filing

The free version of the software includes state tax filing. For the remaining tiers of service, state filing fees are $36.95, up to $5 from last year. Even so, it’s still $13 less than TurboTax. Military personnel, like TurboTax users, can file for free.

Features

TaxSlayer doesn’t have a lot of bells and whistles but improves the user interface and flow. The capability to upload CSV files for investment transactions is a key new feature for 2022 in Classic and over (the previous year’s big feature boost was utilizing an image to populate the W-2 data fields). TaxSlayer has changed the Quick File experience once again, which streamlines the process by allowing you to jump right to the documents you know you need. You’re still eligible for IRS Audit Assistance for a year.

As you progress through paid tiers, you’ll unlock more features, the majority of which are connected to support (which we’ll cover next). The IRS Audit Assistance is extended to three years inside the Premium & Self-Employed categories. More relevant information for 1099 income and additional in-service help to maximize work cost deductions are also added to the Self-Employed tier. A self-employment handbook, quarterly approximated tax payment reminders, and the year tax and income recommendations are also included.

TaxSlaAlthough the Simply Free edition of TaxSlayer covers reduced tax situations than competitors, it does include free phone and email support.

TaxSlayer Classic Help is easily accessible.

The Support Center’s first page is slightly better, with such a tile-style design. However, the site’s visual approach remains a turn-of-the-century throwback once you get past the first page. Classic users can contact support by email, chat, or a non-toll-free phone number (9 a.m. to 10 p.m. ET). Chat is not available to Classic users from inside the service.

The help provided within the service is identical to that provided at the Support Center. So it lacks the depth and detail provided by certain competitors. For example, a search for bitcoin information on the web support within the app yielded the same two unhelpful results.

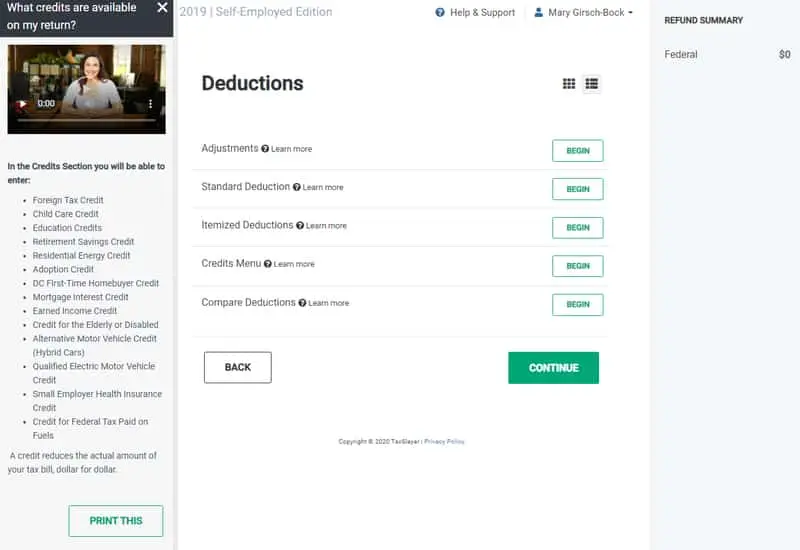

Overall, the design is similar to last year’s, with fly-out panels just on the right that can fold away when not in use. When you click the learn more button on some questions, a fly-out pane with definitions appears on the left. We found the pane on the left to be difficult to read; the eye’s natural flow across the screen moves from left to right. Therefore that pane would serve better as an overlay on the right.

Multiple Security Levels

From the minute you set up an account & log in for the first time, TaxSlayer’s security is obvious. The site requires a complex password and uses a one-time verification code that is sent to your email and mobile phone. You can also use an authenticator tool like Google Authenticator to safeguard your account with a stronger multi-factor verification approach than the SMS one-time passcode, which isn’t ideal.

TaxSlayer also employs a variety of security-related technologies. These include SSL encryption, server-side tools such as intrusion detection systems and firewalls, and data obfuscation. As well as physical security measures such as security officers to prevent access to its data center. TaxSlayer has a staff of professional cybersecurity experts who work with state revenue departments and the Internal Revenue Service. Performs Internal audits are regularly, according to the company.

Using a Mobile Device to File Taxes

TaxSlayer enhances Android and iPhone apps two years ago, but they’re now outstanding. On the apps, you do everything you could on the browser-based edition. You can finish a difficult return on your phone because it supports all forms and schedules.

TaxSlayer designs mobile tax-filing applications to mimic the desktop version’s user interface. The only difference is that one can enter the left vertical menu. You must click a link in the upper left, and some pages are structured somewhat differently to adjust for the smaller screen. TaxSlayer, like its competitors’ mobile tax apps, allows you to start your return with one device and then move to another by logging in.

TaxSlayer Classic Ease of use

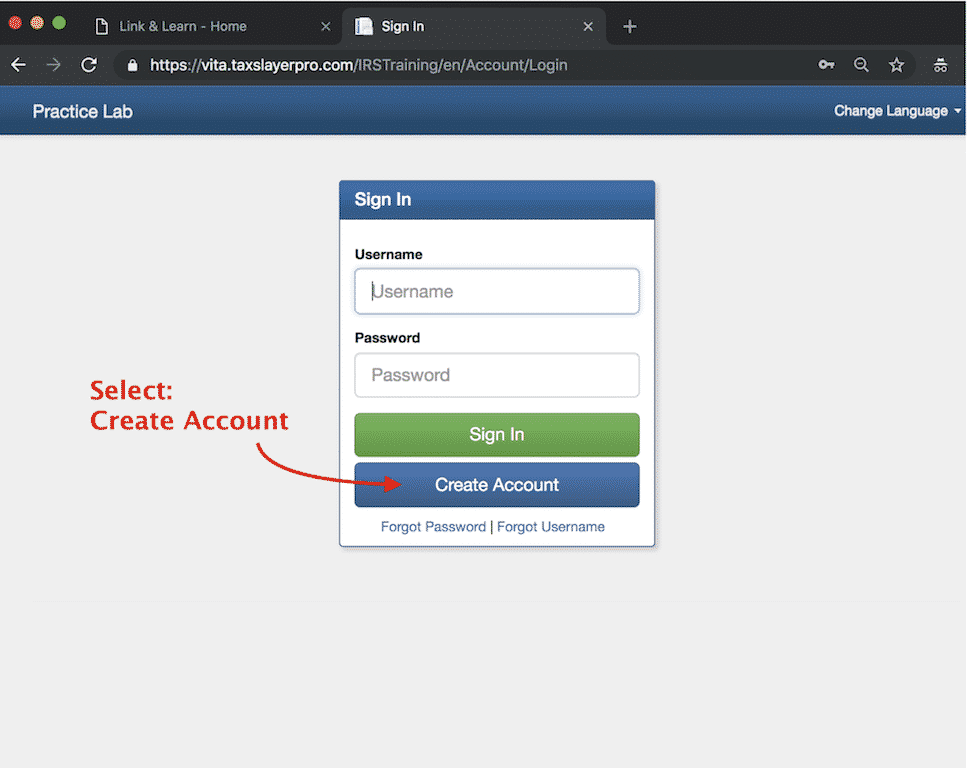

TaxSlayer Classic Signing up

It’s simple to register for TaxSlayer Classic. If you’ve used TaxSlayer before, this welcomes you back and displays either your prior year’s returns (if you haven’t filed a return in a recent tax year, the above screen will even give you the option to file one for up to three years back) or your current year returns (if you haven’t filed a return in a recent tax year, the above screen will even give you the option to file one for up to three years back).

The service deviates from industry standards by requesting you to sign a document agreeing to the service’s terms of service immediately during your first sign-in again for the tax year. Also, it tries to upsell you to Premium if you’ve just begun on your tax return. We skipped over that section and went straight to the Classic edition to finish our taxes.

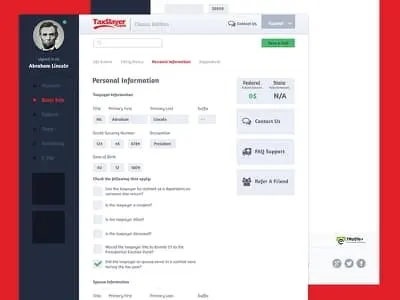

We greet with a simple but stylish UI once we entered the service. The pages are brought to life with large-type headline typefaces and visuals with a pop of color. The center portion is where data enter, with a foldable left pane allowing navigating inside a return and a slide-out right panel as assistance. There have been a few minor tweaks to the UI, and there are a few nice graphic elements, but not that many.

The next screen asked for our entire Social Security number to insert information including W2 data from a PDF of our previous year’s tax return. This year, we skipped the verification and started fresh.

Personal Information

Request your personal information on the initial intake screen (name, birthday, social, and occupation). The second section covers residency follows by a dozen onboarding questions such as whether the deploys taxpayer in a conflict zone affected by a natural disaster calamity during the current tax year. Among these, TaxSlayer includes a question on whether you “received, sold, transmitted, swapped, or otherwise gained financial interest with virtual currency during the current tax year.” The service lacked a learn more info page to clarify the rather stiff language used for cryptocurrency.

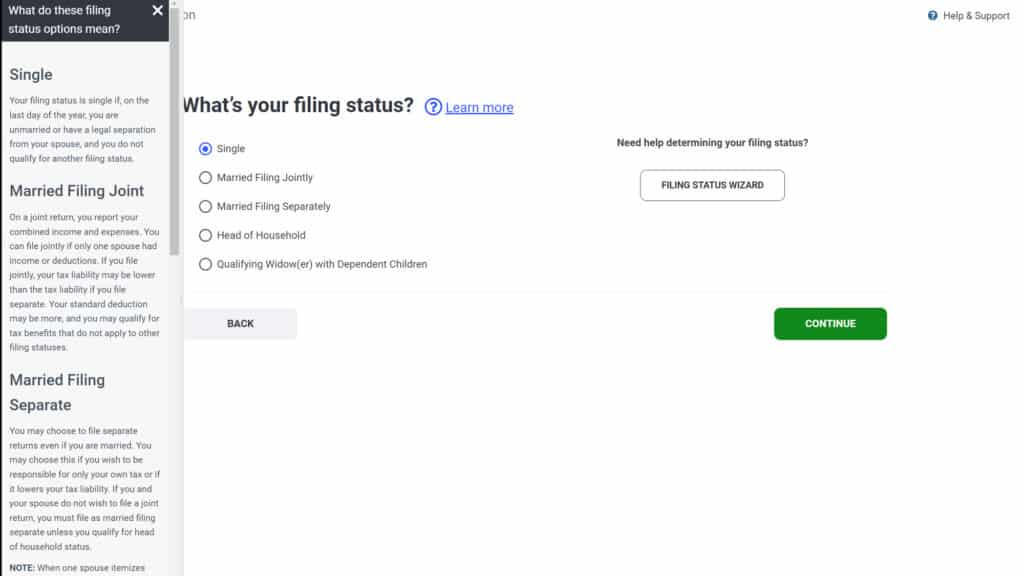

After that, we included the file status. Instead of a learn more window, the service provided a Filing Status Wizard, which leads you through the filing criteria. The next screen was just for adding dependents (though no mention here of the child tax credit). Finally, enter IRS Online Security PIN.

Before getting into the meat of a Federal return, TaxSlayer gives you the option of using Quick File. This enhanced option allows you to enter only numbers or keywords again for forms you require, and the service will then guide you through to the data entry.

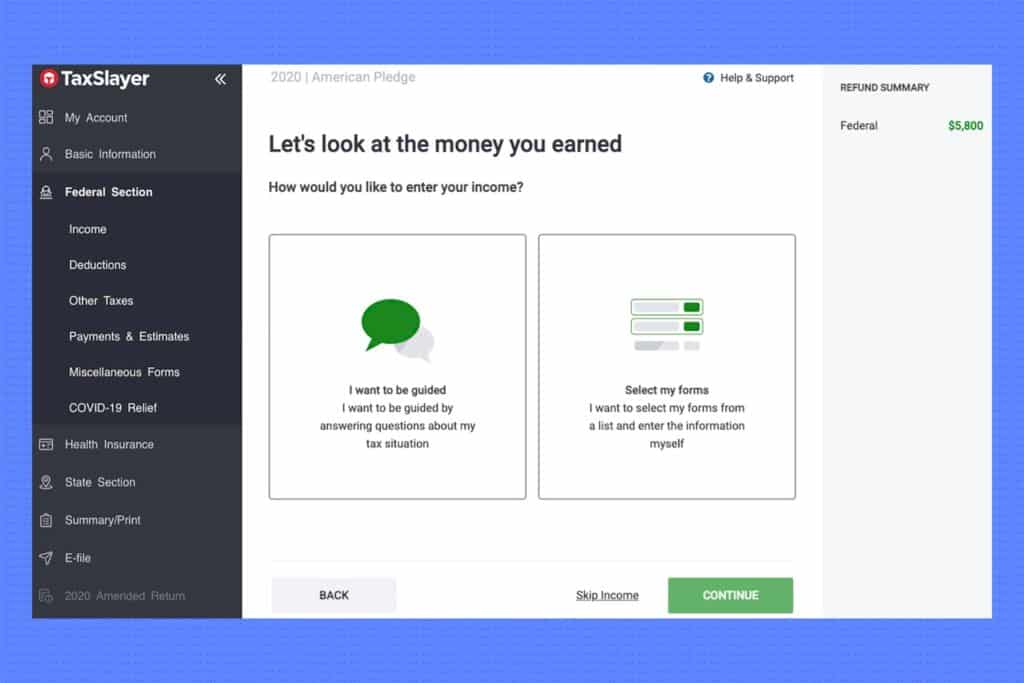

If you skip Quick File, the prompts will change to ask if you are direct navigating (when you respond to questions regarding your tax situation) or to select forms from a list.

TaxSlayer Classic Cryptocurrency transactions

TaxSlayer, on all levels, fails to provide enough support for investors, especially those who conduct cryptocurrency transactions. All data must be manual imports. The author referred to cryptocurrency as “virtual currency,” and checking the item early on didn’t affect the service’s later instructions.

Overall, we like using TaxSlayer, while the interface is not without quirks. The cancel button, for example, did not always return us to the previously finished screen. But instead moved us forward to the next screen.

The responsive design of TaxSlayer allows use on both desktop and mobile sites. A smartphone app is also available for the service. We liked the thorough menu on the left nav pane, which enables you to travel through different portions of the return at your leisure, as well as its ability simply tuck away to preserve screen real estate. Income, deductions, additional taxes, payments & estimates, miscellaneous forms, and COVID-19 Relief are all sections of the federal return (which includes the Child Tax Credit).

Be wary of the constant upsell. Dismissing the adverts became tedious after a while. TaxSlayer attempted to upsell us all to the Self-Employed version of the form 1099-MISC for recording freelancing income. But when that failed, it was the Premium version.

You get support for a greater range of tax forms at the Classic level than most competitors, like Schedule C business costs. We hit another ad upselling three years of audit protection and identity theft tracking for $44 once we got to Schedule C costs directly from the left menu.

Conclusion

TaxSlayer Classic is indeed the best budget tax software since it gets the job done in a reasonable amount of time for a variety of tax scenarios, including self-employment. It does it at the most affordable rate of any paid tax software. TaxSlayer’s instruction, on the other hand, is still lacking in detail. As well as its interface lacks that breadth of required support, graphic design, and welcoming language that our top tax software option TurboTax offers. We’d recommend one of its competitors if you have the extra cash. But if you’re on a budget — and don’t mind some upsells — TaxSlayer is worth a look.

Read more:

- Online Tax Filing with the best tax preparation software!

- Cryptocurrency Why You Should Care?

- How to Return a purchase in-store with Apple Pay?

- iPhone 11 Colors: Which color is best for you?

- Galaxy Watch 4: Best smartwatch of Samsung till now!