If you are someone like me and amped up for what Apple Card is bringing to the credit card market, you are reasonable about a pre-arranged leap in the Wallet app. You’re undoubtedly expecting that impeccable titanium card, Daily Cash, and all of the planning and the executive’s devices to assist you with being mindful with your credit card. Before you go straightforwardly to applying there’s one thing you should do first: guarantee you’re in the best circumstance to be embraced for it! The credit score you need to get approved for Apple Card!

Apple and Goldman Sachs haven’t come out with definite numbers in regards to what your credit score should be to be supported for Apple Card. Yet there are some critical things we do understand that can help us as a whole be basically just about as set up as possible to get embraced.

What we will see here?

What is a Credit Score?

A credit score is a three-digit number that decides how ‘credit-worthy’ you are as a person. It is utilized by moneylenders to appraise that you are so prone to return their cash on a schedule if that they give you a credit. To profit from loans effectively and at low-interest rates, it’s fundamental that you keep a high credit score. A low credit score seriously restricts your buying power.

Credit scores are distributed by credit bureaus. Credit bureaus are organizations that gather credit data and make a credit report for every person.

Additionally, Credit scores are determined utilizing data in your credit reports, including your payment history, the measure of debt you have, and the length of your credit history. Higher scores mean you have shown capable credit conduct before, which may make possible loan specialists and creditors more sure while assessing a request for credit.

What are the Apple Card requirements?

You should meet certain requirements to have the option to apply for an Apple Card. For instance, you should be somewhere around 18 years of age at least and a U.S. resident or legitimately living in the U.S. You should claim an iPhone that runs a compatible iOS. Likewise, if there’s a stop on your credit report, you should lift it before you can apply for an Apple Card. Apple investigates your credit score while assessing your card application.

How to apply for Apple Card?

Apple is making the application cycle very simple. You’re ready to apply for Apple Card directly through the Wallet app. When endorsed, your titanium card will be sent to you through the mail and your digital card will be promptly accessible to use with Apple Pay. If that you need to apply, you can get a direct link directly through the Apple Card website.

What sort of credit score will you have to get approved for Apple Card?

It is reasonable to say that Apple and Goldman Sachs are looking for modestly good financial assessments from the people who wish to have the Apple Card. While some credit cards are planned for those with low or no financial appraisal, Apple Card isn’t worked for those circumstances. You’d be ideally serviced by a secured credit card in case you’re beginning with no credit or working back from awful credit.

In any case, people have been stunned at a portion of the credit scores that are being certified. There have been reports of some being supported with credit scores as low as 620. Thus, you’ll need to guarantee you have in any occasion what is considered “reasonable” credit in case you need a good chance of being avowed.

Most banks and credit providers split the range into groups, going from poor to amazing. And your endorsement and terms you get are constrained by which pack your financial appraisal falls into. The fundamental scope of credit score classifications are as per the following:

- Poor: 300-600

- Fair: 601-660

- Good: 661-780

- Excellent: 781-850

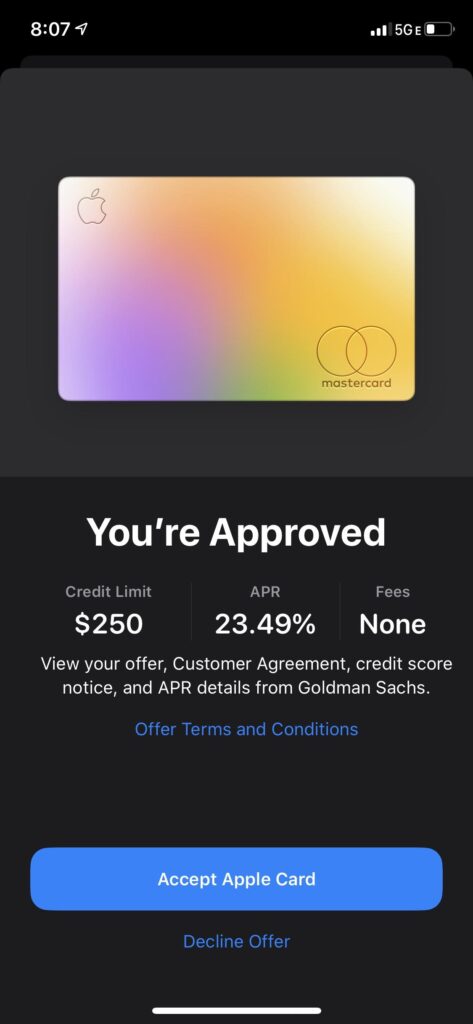

Apple Card offers an APR someplace in the scope of 13.24% and 24.24% dependent on your credit score. And all confirmed cardholders will be set at the lower some portion of the exceptional level they fall into, which will save everyone a touch of premium. Such a wide reach is a promising pointer that Apple will support those without the most heavenly credit score. Yet you can expect a higher loan cost and a lower credit limit.

How would you discover your credit score?

There are different ways you can find your credit score, and a lot of them are free. For a long time, people were basically prepared to check their credit score once every year to no end and would have to pay a cost every additional time. That has since changed, and there are as of now countless organizations that grant you to track and check your credit score. Anyway, numerous events as you would need without paying anything. A couple of these organizations, like. Credit Karma, give your credit score to free similarly as a huge group of various things. These include free government forms, unclaimed cash, and help with inquiries on your credit. A huge load of credit cards has started to give free credit scores to their cardholders too. So check with your card providers to check whether it’s anything but an included benefit with your card.

Ways to improve your credit score!

There are various things that factor into your credit score. Be that as it may, these six are the most widely recognized, arranged by significance:

- Credit card use

- Derogatory marks

- Payment history

- Credit age

- Total accounts

- Hard inquiries

In case that you’re wanting to further develop your credit score whatever amount as could sensibly be expected before you apply for Apple Card. Everything you can for generally manages is to settle your equilibriums. In case you are using more than 30% of your total accessible credit. Attempt to pay this down past that feature definitely work on your score. Create a highlight reliably deal with your bill on time as late installments can be recorded as a negative imperfection on your credit history. Also, attempt to do whatever it takes not to apply for cards close to when you apply for Apple Card. Credit card providers get exhausted when they see a ton of credit demands and requests unreasonably near one another. Research your credit factors and focus on the ones that will have the best impact on you!

Why are credit scores significant?

For what reason is it critical to make progress toward a higher credit score? Basically, those with higher credit scores for the most part get more ideal credit terms. Which may convert into lower payments and less paid in interest over the existence of the record.

Keep in mind, however, that everybody’s financial and credit circumstance is extraordinary. Various lenders may likewise have various rules with regard to giving credit. Which may incorporate data like your income.

The kinds of credit scores utilized by lenders and creditors may differ depending on their industry. For instance, in case you’re purchasing a vehicle, an auto moneylender may utilize a credit score that places more emphasis on your payment history with regard to auto loans.

Credit scores may change as indicated by the scoring model utilized. Furthermore, it may differ depending on which credit bureau outfits the credit report utilized for the information. Some may answer to just two, one or none by any means. What’s more, lenders may likewise utilize a blended credit score from the three significant credit bureaus.

Finishing off!

While you may have to just bounce in and apply for Apple Card quickly, we do understand that everything thing you can figure out how to get ready for it is to comprehend what your score is as of now. And also look at ways you can further develop it. The better your credit situation is where you apply, the better your chances will be of endorsement similarly to specific treatment with a superior loan cost and a higher credit limit.

If your credit score will maintain. There are a couple of credit cards we think pair enjoyably with an Apple Card. This will guarantee you’re intensifying all of your prizes and benefits!