Venmo money transfer app appeals to several users who need to transfer money since it is quick and easy to use. Despite the fact that it is not a money transfer service. While most programs that enable you to transfer or receive money don’t need much effort, Venmo has attracted a large number of customers who like its simplicity and social aspect. Its great app is at the heart of the money-transfer procedure.

The program has recently undergone a number of enhancements. This includes the ability for CVS customers to use Venmo QR codes to pay for their purchases at the register. Users will be able to sell items and services using their own accounts on the PayPal-owned payments app, but for a charge.

Venmo, money transfer app as a result, has a slew of new features that make it a terrific digital wallet-style companion to have on your smartphone, allowing you to shop for goods on the move. Furthermore, Venmo’s social feature has been merged into the service. This allows users to communicate updates about their purchases with their connections. Venmo is perfect if you often spend money with a group of pals, for example.

What you will see here?

Features of Venmo

Despite the fact that Venmo and PayPal are owned by the same company, the former is a far more practical day-to-day option for many more modest payments. PayPal is also useful, but it’s more commonly used for larger payments or transfers. Venmo’s tagline is “quick, secure, social payments,” and that pretty well sums up the app’s appeal.

Venmo’s convenient payment toolbox is available wherever you go. It allows you to pay for items, but with simplicity, and send money to family and friends. Different options enable you to choose who may view your activity, such as Public, Friends, and Private. This is essential if you have a small group of individuals who all contribute to invoices and need to be kept informed.

Students, for instance, who may share housing, may find Venmo money transfer app beneficial for paying utility bills and other such expenses. Venmo, too, has a significant social component, making it enticing to those of us who are always connected. Its usage of QR codes to assist you to make payments quickly and to the proper person is even better.

Pricing of Venmo

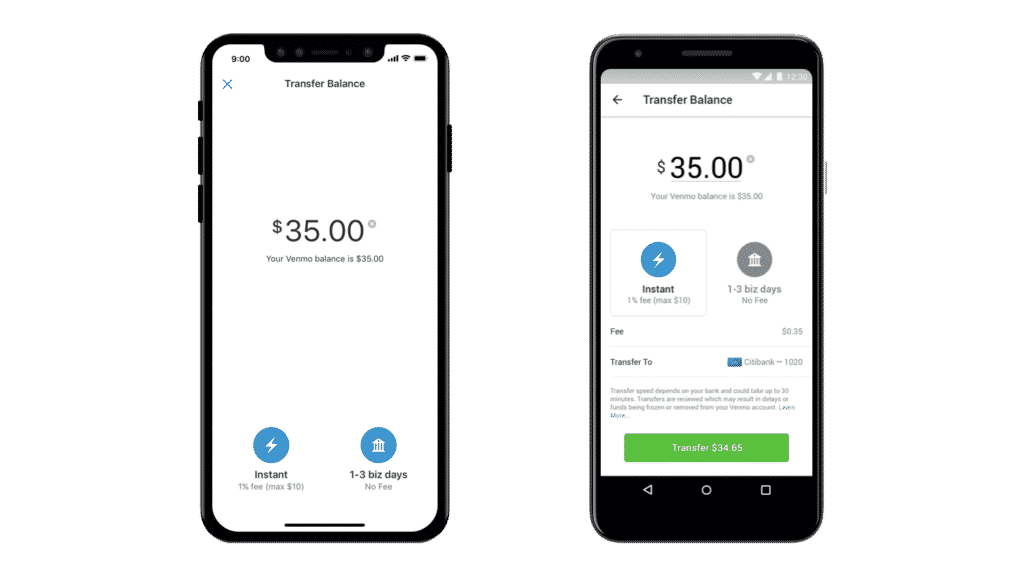

Venmo has kept its costs low and transparent, without monthly or yearly fees to worry about. Expect to pay a 3% charge if you use a credit card to complete the purchase. Another expense to consider is the 1% fee for transferring money from your Venmo account to a bank account. This implies if you don’t wish to wait for the one to three days it normally takes. Venmo, on the other hand, provides a straightforward and straightforward payment solution.

Performance of Venmo

You’ll discover that using Venmo in its app version, whether for iOS or Android, works as it should. It’s evident that having the financial heft of parent business PayPal implies it’s been well-engineered. Venmo may also be accessed using a web browser. So it can be used in a number of settings, including at home, at work, at hotels, and while traveling.

The more sociable you are with Venmo, the better it seems to operate. For instance, if you connect alongside your friends on Facebook who are also using it, you will be able to spend extra money.

Support

There’s a comprehensive online help center that can walk you through most, if not all, parts of Venmo, with comparable support available if you prefer to use your phone. Support may be reached through email, the Venmo app, or online forms on the Venmo website. Chatting with staff is available Monday – Friday from 7 a.m. – 1 a.m. EST, and Saturdays and Sundays from 9 a.m. to 11 p.m. EST, contributing to the social side of the Venmo experience.

Ease of Use

Venmo money transfer app can’t be faulted for its incredibly user-friendly interface. Simply download the app, register, and you’re ready to go. If you prefer, you can join up with your Facebook account. Otherwise, you’ll need to fill in the typical information, such as your name, email, and phone number, as well as a password.

The ability to connect a bank account to a Venmo profile is essential, and Venmo makes this relatively simple procedure as painless as possible. You’ll need to enter your debit card or bank account information, or you can also add a credit card.

With a press of the Pay or Request buttons, you may pay for products, pay someone else, or even ask for money from a friend. You’re done in only a few steps. Even if you aren’t Facebook friends with someone, you can pay them with Venom Codes if they are physically present with you.

Conclusion

Venmo provides a lot of advantages. Particularly for consumers who are used to utilizing their phones for a variety of transactions. The software is well-designed and allows for quick payments in a variety of situations. Venmo will be ideal for people who need to pay for coffee on the move or settle a debt with relatives or friends.

If you’re wanting to make overseas transfers or payments, the service is less beneficial because it can’t currently be utilized for that. Users should also pay close attention to security settings. If you’re not familiar with Venmo’s privacy settings, you may have more information available to the public than you expect.

Venmo, on the other hand, benefits from PayPal’s security technology and protocols. Overall, there’s a lot to appreciate about Venmo, specifically if you have a close circle of friends who also use it and like to split expenses when you gather.

Read More!

- Transfer your money using the best money transfer app in 2025

- Best Mobile Payment Apps in 2025: Quickly pay your bills!

- iPad Pro 9.7 2016 Wallet Case-Put your essentials, cards, and money with your tablet!

- Everything you need to know about Google Pay!

- Enjoy low rate money transfers with the Azimo money transfer app!