Many of Google’s well-known services have a history of updates and repeating themselves. It is no surprise that Google Pay upgraded to become Google Wallet after it killed off Allo, Hangouts, and several other software products to confuse us over the years.

Google has decided to upgrade all Android apps to change Google Pay into Google Wallet. You’ll soon notice some changes if you already use Google Pay. But it’s not relatively that easy.

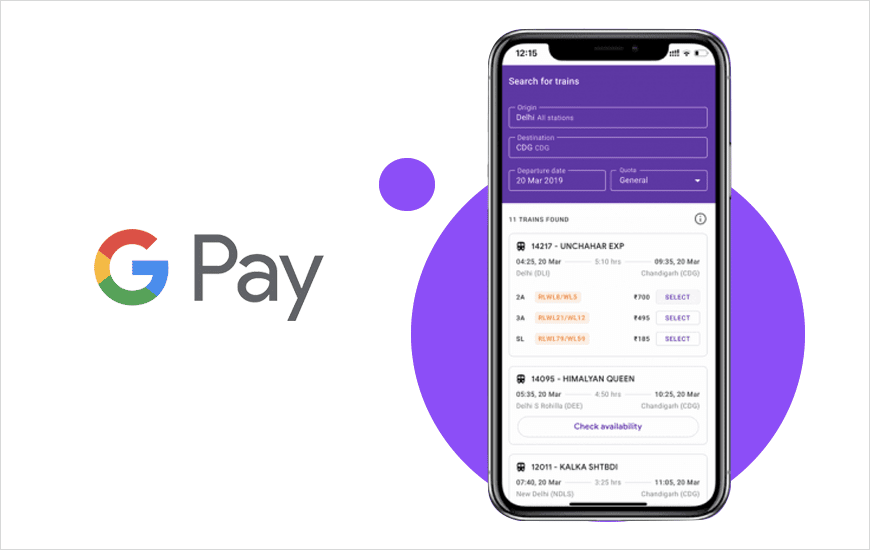

The corporation had already updated Google Pay in Singapore and the US. Oddly, those nations will receive both Google Pay & Google Wallet with essentially the same functionality. However, the redesign will only be available as Google Wallet throughout the rest of the world, and Google Pay will discontinue. Google Pay is the sole option for India. It follows the well-liked Google logic!

Google Wallet closely mimics Apple’s (you guessed it) Wallet program for iOS in its one-stop-shop approach for mobile payments & passes.

Even if the latest edition of the program is still worthwhile, Wallet’s functionality isn’t entirely new. What it can do is as follows.

What will you see here?

How to setup the Google Wallets?

Starting Google Wallet is comparatively simple, especially if you already have a Google account. After logging in, the Google Wallet app will automatically add any payment methods you’ve already authorized through your Google account. The app also provides direct access to your Google contacts.

You can add numerous debit cards and bank accounts to the Google Wallet app and select the default payment system where any money you receive will be instantly deposited.

Sadly, you cannot send or receive money from pals using credit cards with Google Wallet. Although perplexingly, any credit cards you have previously used, Google may be displayed among your Google Wallet payment options. For many who enjoy having the option to challenge fraudulent transactions with their credit card issuer, this is a concern.

Paying With Google

Google Pay, unlike Apple Pay, requires that your phone be unlocked to function. Still, you can also configure Google Pay to demand biometric authentication, just like you can use Apple Pay, PayPal, & Samsung Pay. With Google Pay, you simply unlock your phone & place it close to the point of sale; unless the purchase is substantial and requires a signature, your payment is processed immediately. You don’t have to unlock your phone to use Apple Pay or Samsung Pay, but you must enter a PIN or a biometric login for the payment to be processed.

It was a breeze for you to use Google Pay at a nearby supermarket. The instructions state, “Simply unlock your phone to keep it pressed against the terminal until a checkmark appears. The app doesn’t even need to open.” It was simpler than using Apple Pay on a current iPhone, which necessitates holding the device in front of your face & double the side button, which takes more skill than the straightforward Google Pay procedure.

Limits and fees

Although there are no fees associated with sending or receiving money with Google Wallet, you should be aware that the app only supports debit cards & bank accounts; credit cards are not supported.

Using Google Wallet, you can send up to $9,999 in single exchange or up to $10,000 every seven days. You permit to send up to $3,000 in Florida each day.

Security of Google Wallet

You can configure Google Wallet such that opening the app requires a PIN or touch ID. While you can report suspicious and fraudulent activities to Google within 120 days, Google Wallet transactions cannot return once they have claims, like other money-sending applications in our roundup.

Google wallets transfer an encrypted code that the merchant sends to the card issuer for verification, similar to Apple Pay, Samsung Pay, and almost every other payment application (such as its Android Pay predecessor).

Without mentioning the encryptions employed, Google still boasts that “Google wallet safeguards your payment info with many layers of protection, employing one of its world’s most advanced security systems to help keep your account safe.” They also point users to a 34-second video explaining everything they just mentioned and how to wipe a lost or stolen phone remotely. However, that last point is essential. It implies that you can delete the virtual card & keep your credit card secure even if your phone is theft.

Your credit & debit cards are stored

Similar to before, it will allow you to digitally store your credit & debit cards so you can make purchases if your phone has NFC or the merchant accepts contactless or touch to pay and your phone has NFC.

If you’re using it frequently, it’s an excellent location to view all of your transactions in one location.

They store your payment information more securely

Once your cards register, you may use Google Wallet to make purchases on many mobile websites rather than repeatedly typing in your information or giving it to several merchants.

Your boarding passes pop up

You can avoid printing your digital boarding passes if you’re traveling internationally by downloading them to Google Wallet. Ensure you can quickly discover the notification when it’s time to board. Your app will continuously display a notification on the lock screen and even in the notification shade.

In rare cases, the app can also store other types of tickets, such as concert tickets and vaccination cards for nations that accept them.

Google Wallet keeps your bus and train tickets

If you live in the US, you’ll be more fortunate with this one because, at launch, Google Wallet can only save your transit pass for US subway & rail systems.

Your gift cards and loyalty cards

Additionally, Wallet scans your Gmail, precisely surfaces your store loyalty cards, & stores them as an app for quick access.

Similarly, Google Wallet supports numerous neighborhood stores if you receive a gift card. This covers Tesco, Costa, Asda, John Lewis, & Boots in the United Kingdom.

Your Airmiles memberships

It also locates your Airmiles membership numbers for simple recommendations using comparable scanning abilities.

Conclusion

It’s more of a Google Pay rebrand than a modern app. However, it has a more polished appearance thanks to a visual makeover using Google’s Material You design language and an easier-to-use interface.