Simplifi by Quicken is a simpler approach to financial planning. This cloud-based application makes it simple to keep track of your finances and budget no matter where you are.

Simplifi is now owned by Aquiline Capital Partners, the same company that owns Quicken. Whereas Quicken is a full-fledged private finance package with desktop programs and online/mobile capabilities, Simplifi simplifies tracking accounts, establishing savings goals, and making budgets with a new, visually attractive interface and logical approach. Let us see whether it will be beneficial to you or not?

What will you see here?

Cost and Plans of Simplifi

Simplifi costs $5.99 per month or $3.99 per month when paid annually ($47.99). The firm provides a 30-day free trial. However, you must sign up with a credit card, bank card, or PayPal account. Two plans: Annual and Monthly.

One is its financial plan. The difference between the two is your “spending plan,” or the amount of discretionary cash you have. The spending plan effectively estimates your monthly income and fixed costs.

Some months, the additional money will go toward a trip, while others may go for winter tires for your car and doctor copays. Instead of obsessing over the specifics, you might concentrate on spending inside your means.

Features of Simplifi

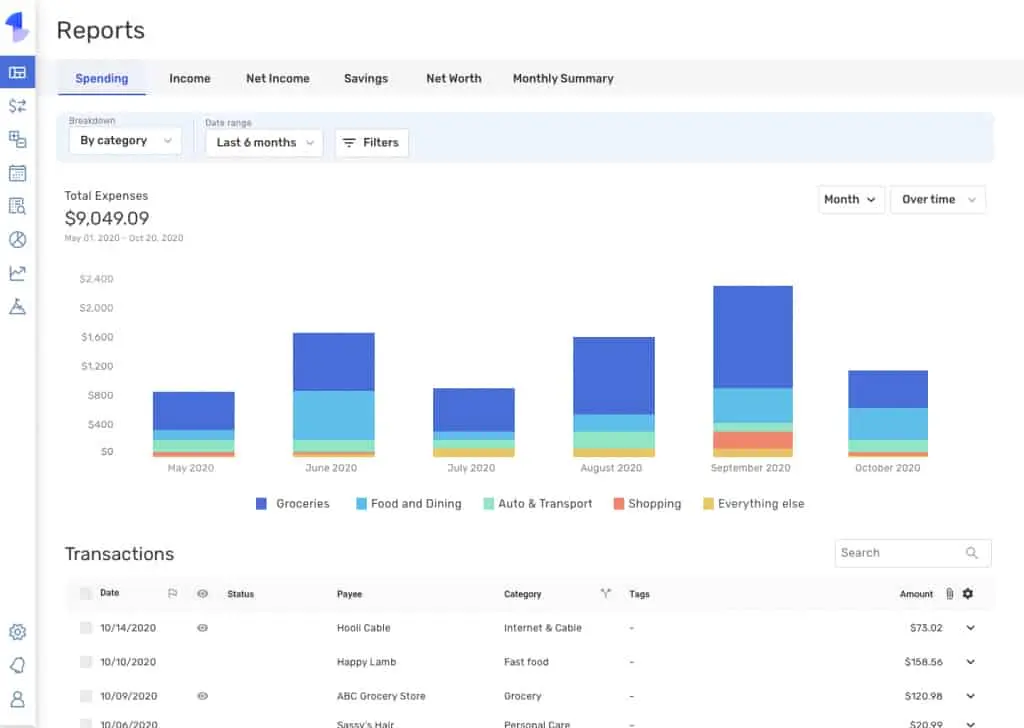

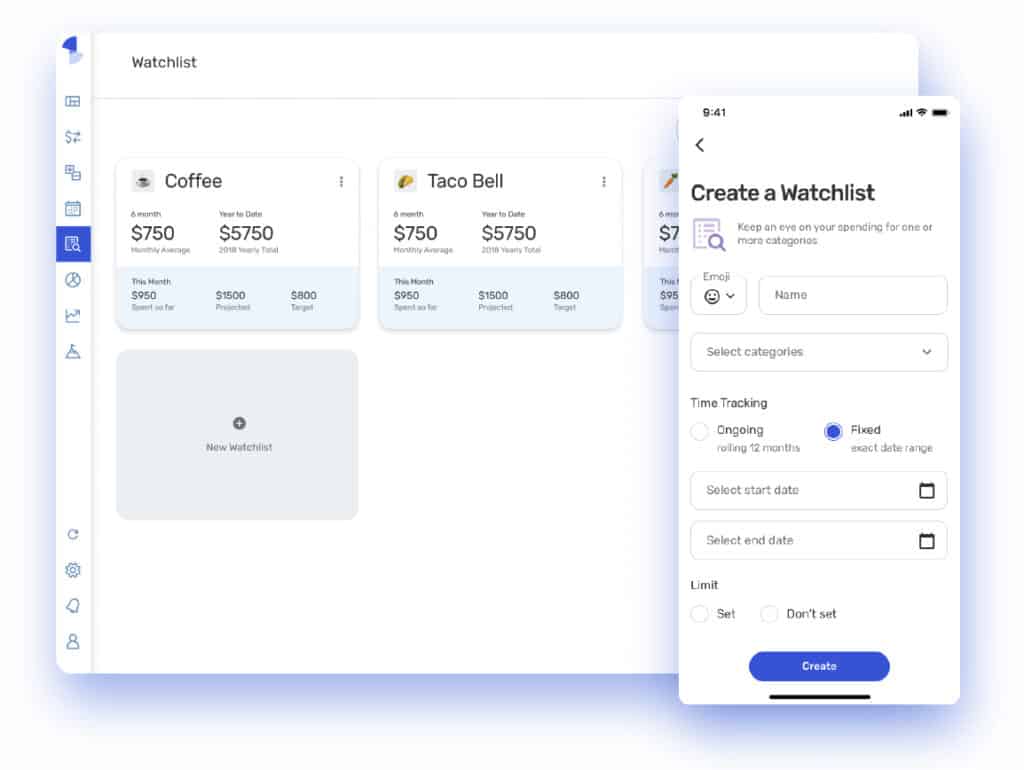

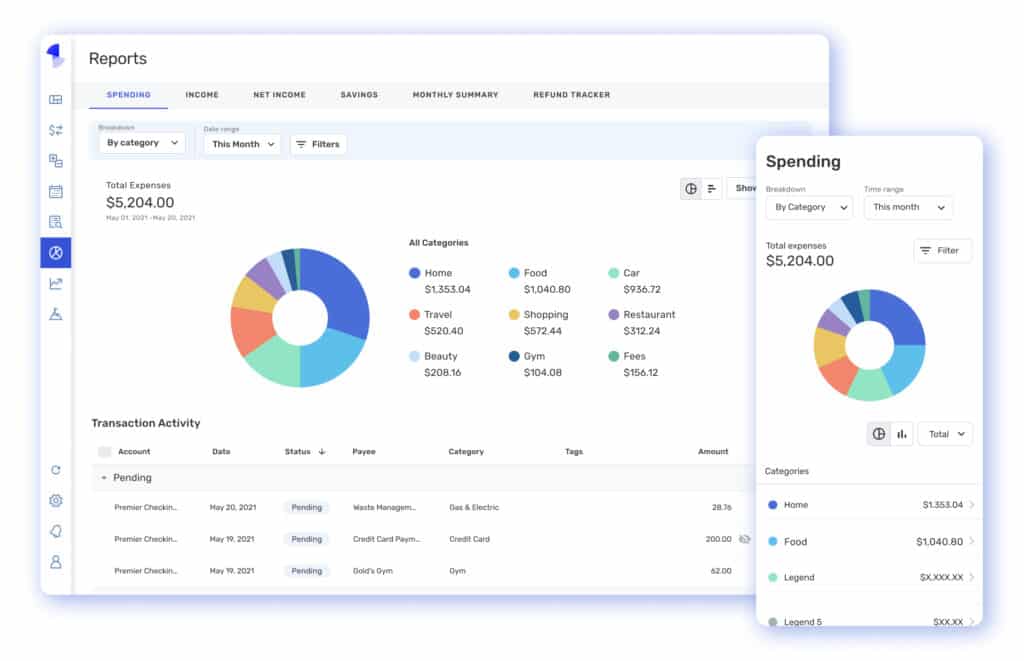

Quicken’s Simplifi is intended to represent your economic condition visually. The program manages account monitoring across banks, investments, credit cards, and payment systems. It combines it with budget and savings plans, bill alarms, and impact on markets of your spending, income, and savings, among other features. Unlike its well-known personal financial brother Quicken, Simplifi originated as a web-only service, and its aesthetic design reflects that.

Simplifi’s feature set compares favorably to Quicken’s Deluxe tier. Quicken distinguishes itself by offering a desktop version for Mac and Windows in addition to its web apps. Also, Quicken provides more assistance with tax preparation and investing. Unlike rival Mint, Simplifi does not support bitcoin investments.

Even though you won’t see the term budget anywhere else in the UI, the service provides robust budgeting capabilities. You may build a monthly budget and select to omit one-time transactions from your monthly spending plan. It can assist with savings goals and give budget ideas based on your expenditure, but it can not build numerous budgets, rollover budgets, or year-long budgeting. However, all of which Quicken can manage.

Available Help

Simplifi features a guided tour that leads you through the parts when you first log in. After you first enter an area, such as when you look at the budget, additional information appears.

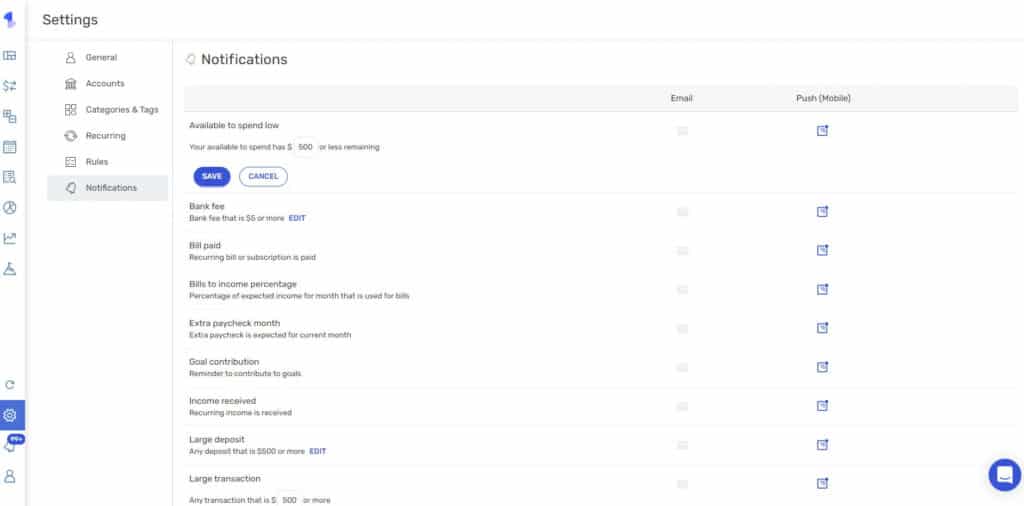

A support symbol appears in the right navbar. Click the question mark, and a chat and assistance pop-up displays to the right of the screen. Look for more information about a subject or make conversation with the robot and later an actual representative. The service provides live chat help 7 days a week from 8 a.m. to 5 p.m. Pacific time. To solve linking accounts, study the help files and the support community. While Simplifi could not provide direct answers, you should locate similar community recommendations that assist in determining what you need to do on your bank’s end to activate the link. Phone assistance is hidden in the help center. However, you may schedule a callback with a coach as soon as possible.

User Experience of Simplifi

Simplifi’s target audience desires simplicity and a user experience that is friendly, straightforward, and uncomplicated. They want to check in and instantly view their account balances, how much spending cash they got left this month, and if they’re on track with their budget. They don’t want to bend over their computers for hours completing the recording, budgeting, and reviewing that Quicken customers must do for the software to run correctly. You also do not want to navigate several menu levels or complicated features.

Simplifi outperforms Mint in this category. On the other hand, Mint offers more functionality; therefore, there’s more data to save. Simplifi, on the other hand, is intended to reduce the time required to obtain answers to financial issues. The site loads its Dashboard, which shows financial accounts in a vertical window on the left. The majority of this page comprises many boxes that include the most typically requested pieces of personal finance information. These data boxes provide condensed versions of features such as the Spending Plan, future transactions, top expenditure categories, and Expenditure Watchlists.

Mobile App

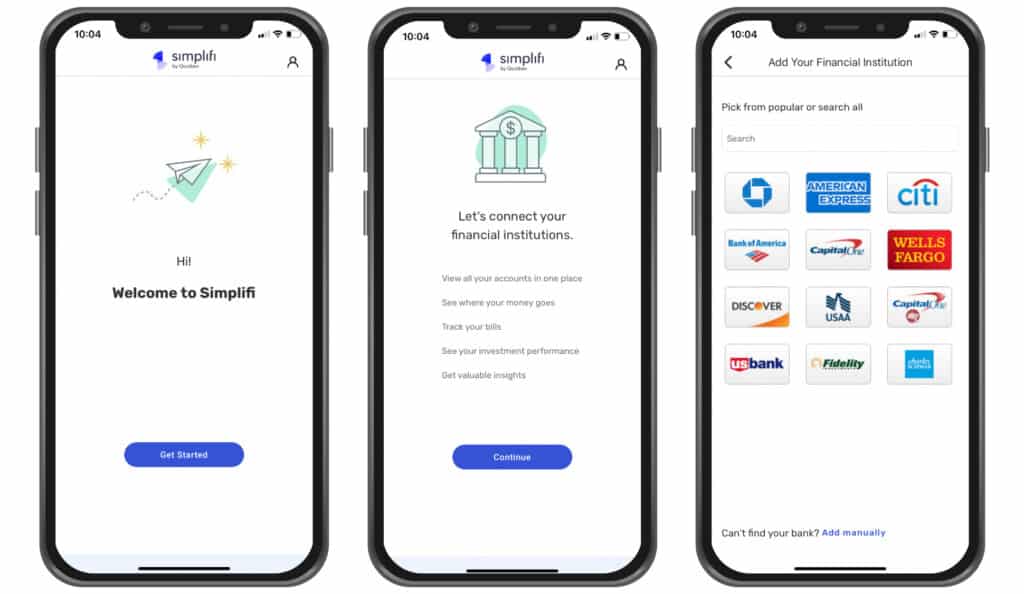

The Simplifi phone app for iOS and Android, like the internet service, is fully customizable. The banking card is on top by default to see your cash at a look, but you can reorganize the cards as you see fit. Each area is revealed by a hamburger menu at the upper left, making navigating between elements straightforward and only a few clicks away. The presentation is stunning, with easy-to-read language, realistic images, and logical arrangement. The functionality is similar to a web browser, although in a smaller version.

Conclusion

Simplifi by Quicken makes it enjoyable to manage your money and delivers reports that help you keep on top of your finances with its sleek design and customizable approach. Users will get impressed with the logical sequence of how budgeting might operate, how users could track how much they spent on different categories, and how they could create savings targets. The program costs $5.99 per month, which is a small price to avoid the obnoxious ads constantly present in Mint’s free competition.

Simplifi and Mint are much more similar than distinct. They examine a broad swath of your financial situation, with budgets being one component that uses the account tracking you’ve previously input. While YNAB is the best budgeting program overall, its primary focus is on zero-based budgeting. So, if you want more extensive net worth and account tracking tools, Simplifi and Mint are your best choices.