The top online accounting platforms offer straightforward tools for sending invoices and paying payments. That is plenty for many firms, but Bills.com is available for those who require more. It automates both accounts payable and receivable using a cutting-edge workflow that no competition provides. Bills can be imported into your company file by you, and Bill.com turns them into electronic records. Bills are paid electronically or by paper check after they have been approved by designated staff. Invoicing is just as simple. Bill.com works well on its own, but if you use an accounting solution, such as Editors’ Choice winner QuickBooks Online, Xero, or a midrange application, you can connect the two and synchronize all transactions.

Bill.com is a helpful tool for small firms, but it is not a traditional double-entry accounting solution. If it is a mistake for one, it will appear to lack crucial elements such as inventory and payroll. Bill.com, on the other hand, is a business payment platform. Since our last evaluation, the service has gained new features and refinements, making it a winner. We like the completely redesigned user interface, enhanced mobile apps, and additional payment alternatives, such as one that promises a 6:00 p.m. delivery time if you make a payment by 10:00 a.m.

What we will see here?

Pricing & Subscriptions of the Bill.com

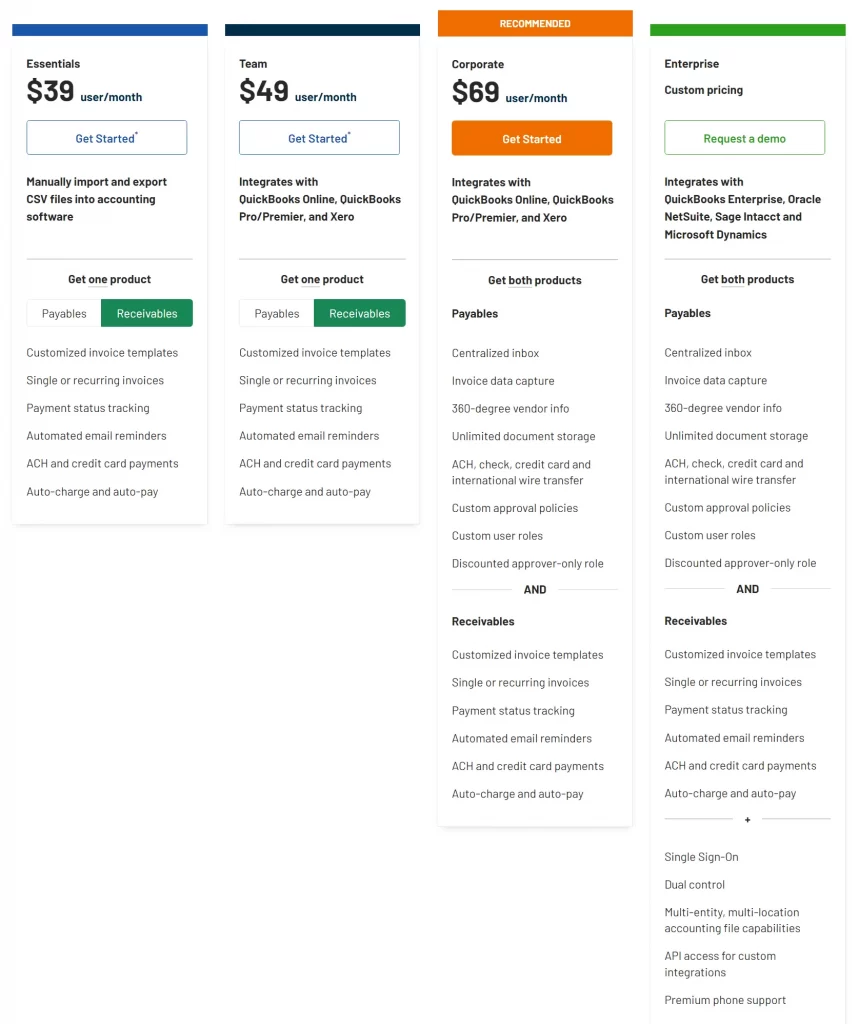

Bill.com has four pricing tiers: Essentials ($39 per person per month), Team ($49 per person per month), Corporate ($69 per person per month), and Enterprise ($99 per person per month) (custom pricing).

Accounts receivable or accounts payable management, approvals and sign-offs, import and export of specific data, and email/chat assistance are all included with the Essentials package. Custom user roles, as well as the ability to link with QuickBooks, QuickBooks Online, and Xero, are available with the Team plan. You may handle both accounts receivable and accounts payable with the Corporate plan. The Enterprise level connects with mid-tier accounting platforms like Oracle NetSuite and Sage Intacct.

Bill.com’s prices cannot be differentiated from those of similar applications because there are none. The corporation sees its competitors as enterprises that have not yet automated their bookkeeping, of which there are many millions in the United States alone.

Setup & Installation of the Bill.com

If you can complete this series of steps, you can utilize Bill.com. The site then walks you through a similar process for submitting an invoice, creating a customer record, and so on, albeit these steps are optional. Simply proceed to the settings page to configure additional areas of your account Payables, Receivables, and Accounting.

Most other financial websites I’ve looked at don’t recommend making transactions that soon. I normally recommend that new users begin by establishing preferences and creating records before beginning to work.

In Bill.com, the process would entail a slew of chores, such as connecting the site to your accounting software. If you’re using Bill.com on its own, you can import CSV files including databases of customers and vendors, items, accounts, and so on.

User roles allow you to control who has access to which bills. Several user roles are available for administrators, accountants, clerks, approvers, and others. Policies can also be established to control bill approvals. For example, you may decide that certain bills do not require approval and can simply be paid. By guiding you through the basic stages at the outset, you will learn how simple it is to adhere to the workflow. So, before you start messing about with additional settings on Bill.com, it’s a good idea to become acquainted with the site’s main functions.

Navigation in the Bill.com

Bill.com offers five boxes on the Overview page: Bills to Pay, Open Invoices, Bill Approvals, Payments In, and Payments Out. They display a summary of what is due, overdue, and coming up. Having this information front and center when you first log in saves time and may help you catch transactions that you might have missed otherwise.

Toggle up a right vertical window holding your to-do list and other chores that require attention. For example, bills that do not comply with your company’s approval criteria. When you click through to these chores and finish them, the removal of the list takes place. Bill.com’s navigation tool has entirely been redesigned since my last assessment, and it is now much more elegant and usable. In the left vertical pane, a sequence of little icons appears. When you hover over this list, an extra list with matching text descriptions for each icon appears. When you click on the top link, Actions, a menu of activities that you may access immediately from there appears (Enter a bill, send an invoice, and so on). All of the other choices in this menu will lead you to the main sections of the site.

The first component is divisible into three parts: Overview, Inbox, and Documents. The following two sections are Payables and Receivables. Hovering over a menu entry that can link to numerous linked pages opens a submenu. You should have no issue viewing or entering information once you’re on a working screen. Bill.com makes use of conventional navigation and data entry patterns, such as drop-down menus, fill-in-the-blank fields, and links to related pages.

Security of the Bill.com

One of Bill.com’s most vehement criticisms is its list of outstanding invoices. You can examine the approval status of each bill at a glance and bulk pay the approved ones if you’re authorized. If you need to see a bill before paying it, you can open the record and any original bills that exist by clicking on the invoice number.

To access the Audit Trail, click More Actions on this screen. This page includes a thorough record of every time an employee “touched” the bill. It details the action is taken, who took it, and when it was taken. It explains what is the problem and which fields are effective. When many employees have access to approval and payment tools, this level of security is necessary.

Obtaining Payment

Bill.com began as an accounts payable-only website, but it long ago included accounts receivable capability. The website includes enough accounts receivable capability for a small business that does not need to maintain inventory to manage its receivables. You can keep track of your interactions with customers by creating customer records, which you can then use in invoices. Sub-customers and credit notes are also available, and Bills.com offers an audit trail for receivables that is comparable to that payables.

It is simple to create an invoice. If you use the offered default form, you fill it out by selecting options from drop-down menus and entering data into the designated fields. There are three templates to choose from, each of which is customizable by adding or removing standard fields. Those field possibilities are just as extensive as those seen on most accounting websites. Invoices may include items such as sales tax, discounts, and payments. Attachments are available, and email delivery of complete forms. Recurring invoices are also possible.

Customers can authorize payment for invoices you’ve issued by logging into a password-protected portal. They can also authorize automated payments from their bank accounts or credit cards, which can help you get paid more quickly but must be carefully set up. Bill.com’s accounts receivable aren’t as complicated as the site’s accounts payable, but they don’t have to be. The tools supplied are adequate for a small firm with simple invoice requirements. Furthermore, if you utilize the site in conjunction with an accounting app, you’ll most likely make your invoices in the other program.

Conclusion

Bill.com is in a league of its own. No other service offers a comparable combination of features that can be useful as a standalone application or seamlessly integrated with major accounting software. Bills.com does not claim to be a full-fledged small business accounting solution. Rather, it goes beyond double-entry accounting services in the payables and receivables divisions.

Read More!

- How to set up and manage Apple Pay on the Mac?

- How to add your bank account to your Apple card payment option?

- Navigation on iPhone and iPad-Everything you need to know!

- Customize Maps with Map settings on your iPhone and iPad!

- Google Maps gets eco-friendly routing, bike and scooter sharing information, and lite navigation for cyclists!