Apple Pay support has officially arrived in the country of Bahrain with help from at least 3 of the main banks withinside the country. According to the banks, customers in Bahrain might be able to take benefit of faster, easier, and safer bills while enjoying all the benefits of their physical cards. The rollout of Apple Pay in Bahrain marks the 5th country in the Middle East and North Africa region to get the Apple contactless payment platform. Back in August, Apple Pay officially landed withinside the country of Qatar.

What we will see here

Major banks supporting Apple Pay in Bahrain

Apple Pay support has formally arrived withinside of Bahrain with help from as a minimum 3 of the important banks withinside the region. The National Bank of Bahrain (NBB), the Bank of Bahrain and Kuwait (BBK) and ila Digital bank have all introduced assist for the Apple digital payment platform in Bahrain. That’s located withinside the Persian Gulf.

NBB, for example, says its clients can enjoy faster, easier, and more secure bills with its Mastercard and Visa cards supported. Ila Bank invites its customers to experience all advantages of their card while the usage of Apple Pay.

BBK, on the other hand, is the only offering help for its debit cards, and in an Instagram publication, it promotes a Visa card. You can now enjoy all the advantages of your BBK Debit Card using Apple Pay. It’s an easy, secure, and personal manner to pay.

In August Apple Pay was released in Qatar with the QNB bank. While rumours recommended the South American country Chile will be next, it was Bahrain that received support first.

Adding a card to Apple Pay

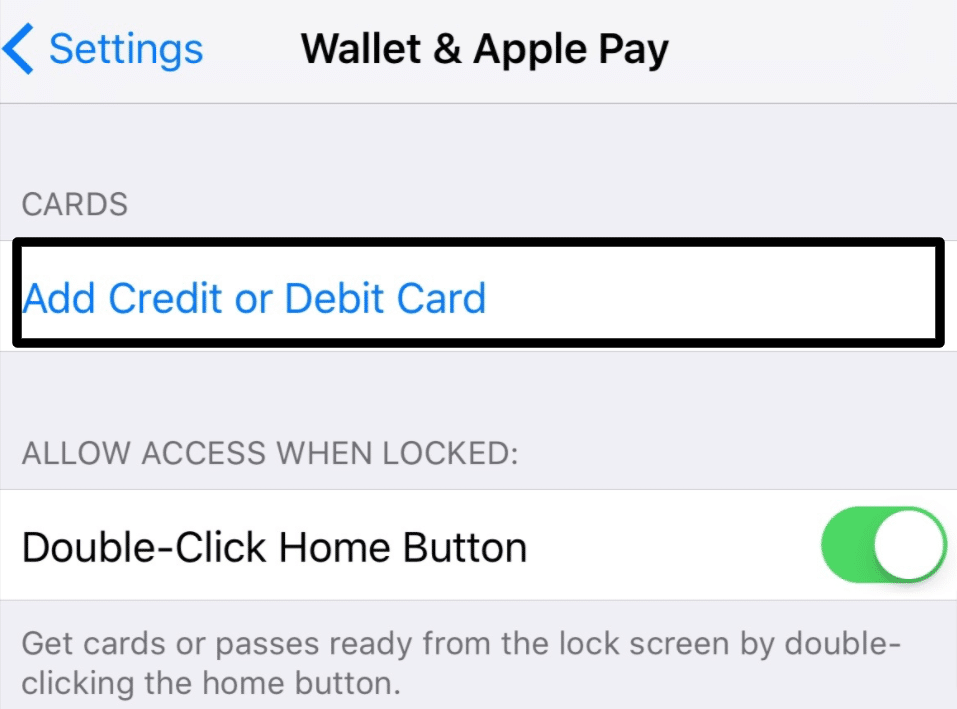

- Fire up Settings go to Wallet & Apple Pay.

- Tap on Add Credit or Debit Card.

- If your iTunes & App Store account already has a well-suited card on file, iOS will automatically propose adding it to Apple Pay.

- If not you’ll want to either take a screenshot of your card or enter it manually.

- Depending on your bank, you’ll need to confirm thru phone, SMS, or e-mail.

- Most big banks will send you an SMS verification code. While others may require you to name the bank to confirm your identity.

- This system may be immediate, or sometimes take numerous days to finish depending on your bank.

- Once verification is done, you’re all set up!

- Now you’ll be capable of experimenting with your iPhone at any store, restaurant, or fuel line station. That accepts contactless payments, use it in apps, on the web, or ship/get hold of cash from pals or family via iMessage.

Conclusion!

The biggest advantage of Apple Pay is privacy and security. Apple Pay is almost unhackable. Nobody can ever steal your credit card data from Apple Pay. The credit card variety utilized by Apple Pay isn’t always similar to the real card that turned into delivered to apple pay. The tool generates a separate number that the issuing bank associates together along with your iPhone and that number can most effectively be utilized by apple pay to your iPhone. If all people steal that variety somehow, they won’t be capable of doing whatever with it. Since the bank will most effectively authorize a transaction from your iPhone.

Read More!

- How to add your bank account to your Apple card payment option?

- Best Portable chargers 2020- Portable chargers to keep your gadgets going!

- iPad 2 Wallet Case-Best for keeping your cards, money essentials, etc.

- iPad 3rd Gen Wallet Cases-Perfect to carry your cards, money, etc!

- Best Portable CD Players to choose from!